The Power of Automation in Data Migration

Automation is a practical solution to speed up and optimize the entire data migration process

Companies are facing a dilemma with regards to inventory and working capital management. On the one hand, an environment with ongoing global disruptions, volatile demand and unreliable supply requires more inventory as buffer. On the other hand, the inflation and a weak economy put an immense pressure on companies towards leaner inventories. In this article, we discuss how this dilemma can be overcome and how inventories can be effectively managed in challenging times.

Inflation is not only increasing the pressure on the cost of goods, but also impacting long-established ways of managing supply chains – like inventory management. As it is driving up direct costs for materials, labor, energy, and transportation, manufacturing, storing, and shipping goods become much more expensive. The rise of U.S. storage pricing by more than 10% year over one year illustrates this clearly. Additionally, interest rates have risen back to levels not seen for more than a decade, putting higher pressure on companies to professionalize the management of working capital and inventory buffers.

Besides the ongoing economic crisis, the global logistics market has still not recovered to pre-pandemic times. With heavy delays in manufacturing and shipping, lead times for the transport and supply of raw materials and components are very unreliable, making deterministic methods for planning and inventory parametrization more unfit than ever.

With this dilemma of upward and downward pressure on inventory levels in place, companies are struggling to take correct business decisions in managing inventories. In a nutshell, inventory is more important than ever before to reliably sustain supply in a disruptive environment, but at the same time expensive as never before. How to overcome the inventory management dilemma? From our experience, it needs a fundamentally different approach along six dimensions to live up to the challenge.

A new inventory management approach needs to evolve different dimensions in an organization. The key to unlock the situation is a data-driven and more proactive stock parametrization logic, with continuous screening of the environment, and continuous adjustment of targets levels. Also risk stocks – which often have been defined in a more rule-of-thumb or judgement-based way – need to be optimized based on data & analytics. Furthermore, the underlying drivers of inventories, such as demand variability or manufacturing lead time, need to be pro-actively managed and improved. Lastly, inventory management needs to be tightly integrated into overall processes and governance: this includes for example the correct integration with financial and budget planning, but also establishing a center of excellence that bundles the advanced capabilities for E2E inventory management in one central unit. Figure 1 depicts these pillars. We will explain each one in more detail in the following chapters.

The foundation of modern inventory management is thinking of inventory as dynamic and adaptive, and as an outcome of a continuous stream of data which senses both the maturity of the supply chain (e.g., lead times, planning quality, reliability of execution) and includes factors from the environment (e.g., disruptive events, demand variability, supplier reliability).

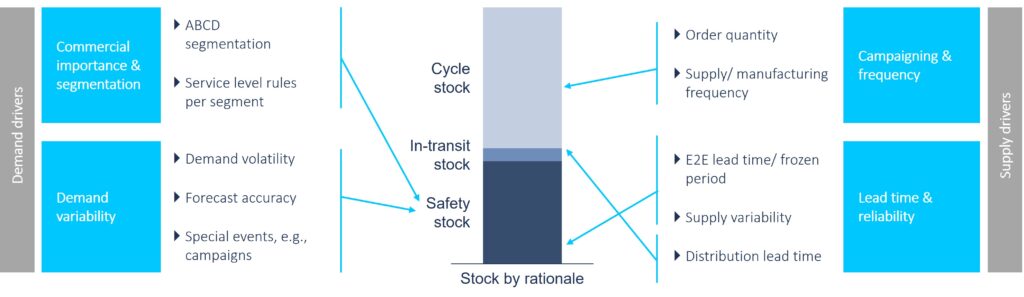

This stream of data needs to relate to the right level of inventory parametrization based on a clear set of business rules, as outlined in figure 2. On the demand side for example, the commercial stock availability targets and prioritization/ segmentation are major drivers of the required safety buffers. These commercial inputs are by no means static, but continuously fine-tuned and adapted. On the supply side for example, the material, capacity, and labor shortages in 2022 have shown the need to dynamically adjust buffers to the environment. As a conclusion, driver data for inventory adjustments are to be maintained in a data lake and continuously updated, including the use of trending and signal detection to allow early identification of new patterns in the data.

Instead of looking at inventory levels top-down, starting with the drivers enables a bottom-up view and helps understanding the cash price tag of the current supply chain set-up. Asking questions like the following is the starting point for sustainable inventory optimization: Which underlying commercial segmentation supports the inventory strategy, and is it still up to date? How high is the demand volatility and how can forecasting performance be improved? How are re-order quantities derived? Do they depend on batch sizes or the manufacturing frequency? How does this influence the stock levels? What is the E2E throughput time and how does it disaggregate in different process steps? How can lead time be reduced on average, and how can variability around the average be decreased?

Collecting data once or twice per year and recalculating stock parameters is clearly outdated. Companies need to move towards a continuous and real-time adjustment of the key driver data for stock levels. From our point of view, this includes four key capabilities:

In the current disruptive environment, structural preparedness through the right level of risk stocks plays a vital role. At the same time, risk stocks need to be deployed in a very thoughtful and economical way, not only based on rule of thumb or experience. Thus, companies need to further upgrade their capabilities and move to a quantitative determination of risk stocks.

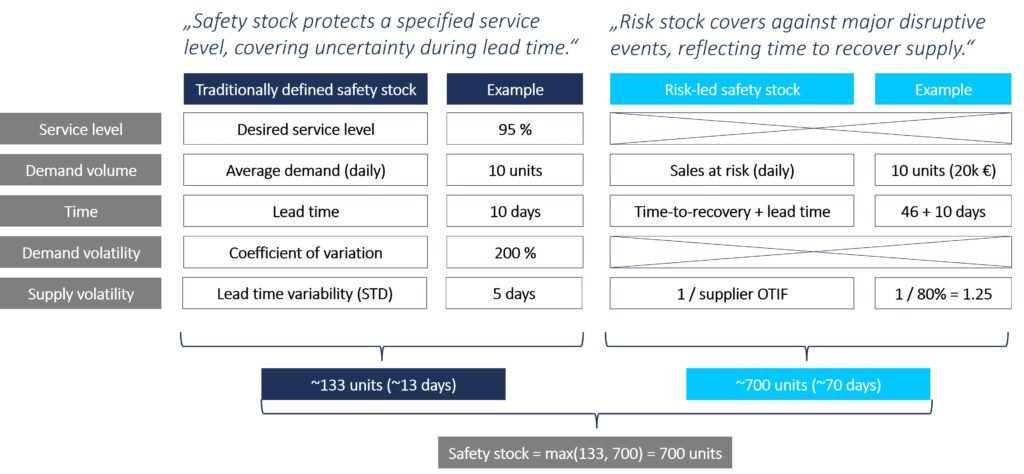

Safety stocks are typically defined to buffer against uncertainty – of demand and supply – during replenishment lead time from one node to another. It is important to differentiate that the measures of uncertainty, like e.g., demand variability, rather focus on the so-called known unknowns, the typical variability of demand and supply patterns in recent history, e.g., the last three years.

In contrast to that, risk stocks need to be dimensioned to minimize the business impact of major infrequent disruptions (unknown unknowns). The logic of calculation is fundamentally different:

In general, risk stocks need to be applied much more selectively than safety stocks. Holding risk stocks to minimize sales at risk during recovery from an (unknown) event is expensive and should only be applied for key strategic products/ customers or particularly weak nodes in the supply chain. Thus, risk stock should finally be deployed from an E2E network perspective, allocating the available risk inventory budget to the stock points with the highest sales value or margin at risk per 1 million Euro of risk inventory.

Figure 3 shows an example for the calculation of a traditionally defined safety stock including known demand and lead time variability versus a risk-led safety stock. The traditional formula leads to a safety coverage of ~13 days of stock, while the upstream focused risk-led safety stock leads to approximately five times this quantity, adding up to ~70 days of stock.

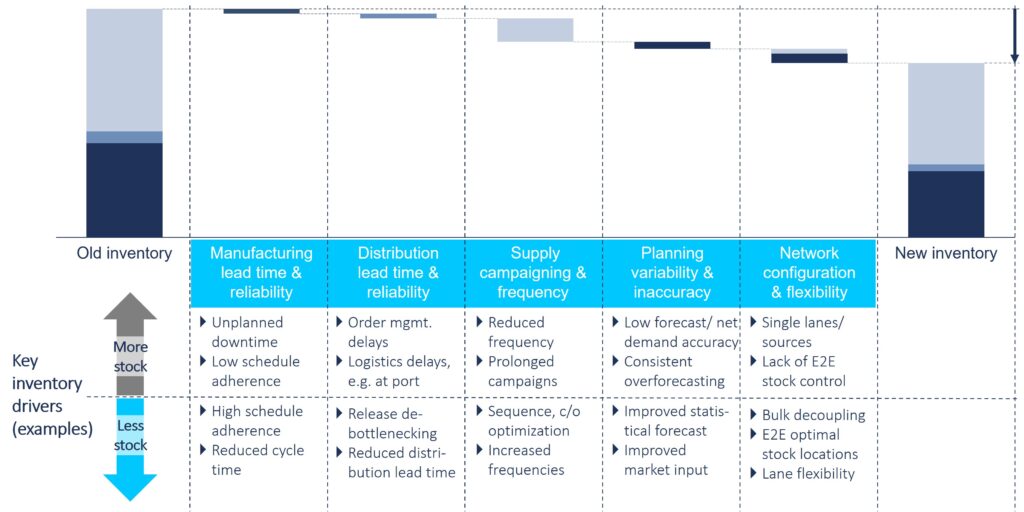

Improving process maturity is the lever to structurally improve working capital despite a more volatile and uncertain supply and demand environment. Under given external conditions, the best level of inventory reflects the maturity of supply chain design and operations, like for example lead times, manufacturing & order frequencies, internal variability, planning errors, and network flexibility (see drivers outlined above).

Only by addressing these levers as outlined in figure 2, companies will sustainably improve their working capital efficiency. Over-simplified, other changes are window-dressing at the expense of service level and cost performance. Consequently, the cost and inflationary pressure calls for continued efforts to structurally improve supply chain maturity.

To achieve this aim, a strong cross-functional collaboration is needed: experts from manufacturing, quality, sourcing, logistics, and planning need to work together to reduce cycles times and increase lead time reliability. Only an agile and reliable manufacturing set-up will allow taking out inventory buffers along the value chain, be it in raw materials, WIP, or finished goods.

As another example, minimizing internal variability and planning inaccuracy is key, as many stock levels are only covering a lack of strong planning and coordination. This can for example be seen when scheduling or production on a production line based on a tactical plan is not possible due to wrong assumptions on output per hour, OEE, or labor/ material availability. This immediately will lead to additional waiting times, and indirectly to suboptimal safety buffers of production to protect against planning errors.

Thus, supply chain management needs to effectively collaborate with all functions to increase overall process maturity, and improved inventory management will come as a result. Figure 4 shows the different inventory drivers and specific examples that result in an increase or decrease in stock.

Inventory management can only work smoothly if it works closely integrated with other functions than supply chain management and embedded in cross-functional governance. Of special importance are the integration of supply chain management with finance, commercial, and manufacturing:

Strong inventory management is much more than just technicalities and formulas. As outlined above, a strong governance is needed which clearly delineates responsibilities, establishes transparent decision rules, and creates an open, collaborative environment between Supply Chain, Finance, Commercial, and Manufacturing.

The high importance, cross-functional nature, and reliance on data & analytics make it clear that inventory configuration and parametrization should be far more important than ‘just another activity of supply planning’ in sites, DCs, or countries. Inventory parametrization must be data-driven, and companies need a strong center of excellence which applies a transparent methodology to continuously update and monitor inventory-related data along the supply chain, monitor stock target adherence to parameters, and adjust stock parameters.

This does not imply the centralization of inventory management decisions, but a modern 3-tier structure of decision support and decision making. As the 1st level, the center of excellence ensures a consistent methodology, rules, processes, data, and tools, plus runs the inventory analysis and re-parametrization. On the 2nd level, parameter adjustments are proposed to supply chain planners, which can calibrate the analytical results with deep understanding of the end-to-end value chain, supply situation, and market and portfolio knowledge for their area of responsibility. On the 3rd level, the supply chain planners align the appropriate parameter changes with the respective stakeholders, e.g., decision makers in manufacturing sites, distribution centers, and commercial regions and affiliates.

Thus, a center of excellence for inventory configuration and parametrization provides a consistent foundation in data & analytics, inventory simulation, and decision support for this highly critical supply chain topic.

As we have outlined above, the current rather challenging environment calls for improving supply chain maturity, and professionalizing inventory management as sketched in this article is a key building block on that journey. Beyond reviewing and benchmarking the current inventory levels to identify steps for quick improvement, companies should also take a step back and review the six elements of modern inventory management to determine where more structural improvements are feasible to sustain better working capital efficiency in the long run. This can only be successful in a cross-company effort: with supply chain functions in the lead role, and with close involvement of production, commercial, and finance.

We would like to thank Florian Kreitz for his valuable contribution to this article.

Automation is a practical solution to speed up and optimize the entire data migration process

Discover how you can streamline your financial master data management and reengineer financial processes with SAP MDG Finance.

Whilst it seems straightforward to carry out either a blood transfusion or a data migration, the actuality proves far more complex.

In this blog article, Camelot introduces you to the main principals of Demand-Driven Supply Chain Management.