Navigating Pharma Logistics: Trends, Challenges, and Solutions for 2025

The pharma market trends impact logistics with a shift to smaller, higher-value shipments and new temperature requirements.

The order-to-cash (OtC) process is essential for any company because it ensures the inflow of cash. It is an impactful process that requires cost efficiency while responding to increasing customer expectations. However, in many companies this important process has been neglected. In a series of three articles, we show you how you can take your OtC process to the next level and outplay competition.

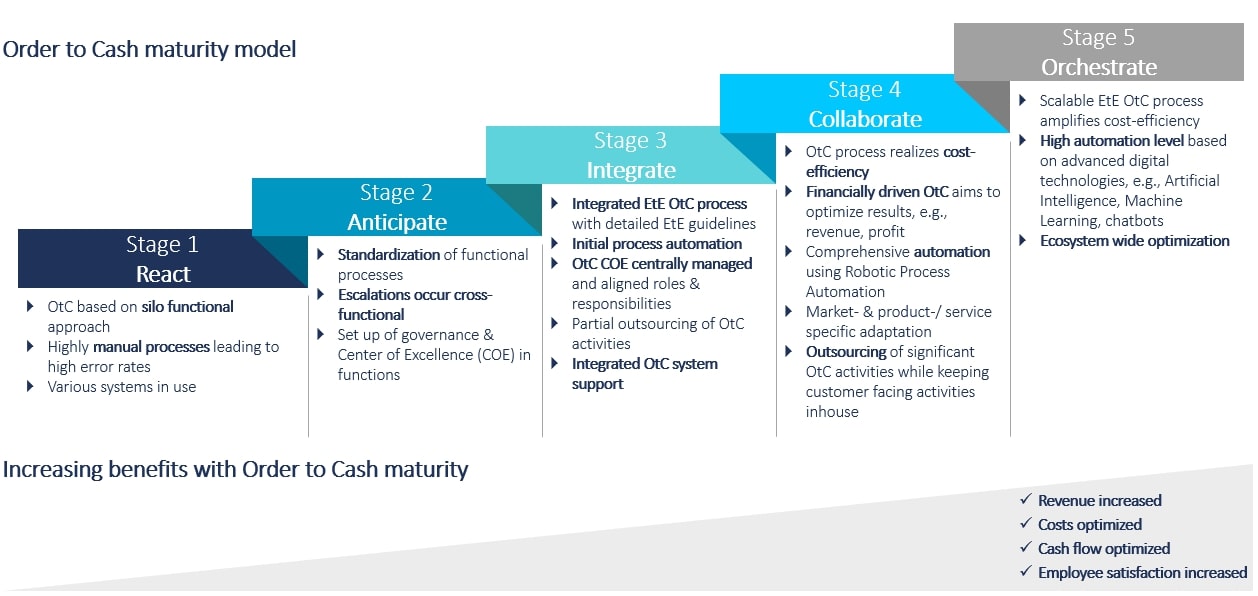

In this first article we explore how companies can benefit from improving their OtC process and introduce a maturity model. With our maturity model, companies can benchmark their current performance and identify required capabilities they need to acquire in order to reach their desired maturity stage.

The order-to-cash process is one of a company’s key activities as it secures the inflow of cash. It is therefore important that the process runs continuously, reliably and with minimized risk. This objective can be reached by improving metrics like “payments received on-time and in-full” and “days sales outstanding”. Early risk warning systems need to be in place, for example to assess the creditworthiness of customers. Additionally, on-time and in-full delivery is required to obtain a fast and complete payment from the customer.

Automation and standardization of the OtC process offer many opportunities to increase cost efficiency, such as a no-touch order conducting, an automated availability check, or an automated order to billing conciliation. Process standardization further prevents expensive ad-hoc and firefighting activities. Outsourcing of non-customer facing activities such as collections and customer payment processing offer additional possibilities to increase cost efficiency.

B2B customers increasingly expect their suppliers to provide them with a customer experience they have got used to in their private lives, e.g., when ordering products online from Amazon or other online stores. This implies a standardized process focusing on reliable delivery commitments and transparent real-time tracking. Advanced companies offer their B2B customers convenient self-service options where they can track their order, make changes, and perform the payment. In addition, customers expect suppliers to be flexible, and respond quickly and effectively to their request, such as changing delivery dates.

To remain competitive in a volatile word, now is the right time to bring the order-to-cash process to the next stage. We have developed a five-stage maturity model for order-to-cash process excellence which helps companies to assess themselves, set their target stage and identify the right activities to reach it.

Companies in the first stage of the maturity model find themselves inefficiently reacting to their environment instead of steering the end-to-end order-to-cash process. Often, a decentral and silo functional approach is followed. Activities are performed manually, resulting in high error rates, e.g., incomplete orders due to order acquisition via phone or mail. The use of various systems further increases manual work and prevents end-to-end transparency. An order-to-cash governance model is not implemented and aligned roles and responsibilities along the process are missing.

On this level, the order-to-cash process within the individual functions is standardized and supported by workflows leading to increased efficiency. Process governance and Centers of Excellence (CoE) are introduced within the functions. However, lacking synchronization amongst the functions regularly results in cross-functional escalations. Missing integrated end-to-end processes and systems further enforce the escalation potential.

When located in the middle of the maturity model, a company understands the order-to-cash process as one end-to-end process with guidelines and harmonized interfaces across all functions. A central order-to-cash CoE is in place and assures compliance of aligned roles and responsibilities. Low value adding activities are outsourced to shared service center. Initial process automation accelerates and simplifies the internal workflows, so that orders are for example automatically created and checked for completeness.

The comprehensive automation of the end-to-end order-to-cash process in stage 4 leads to cost efficiency. Technologies like Robotic Process Automation are implemented to automate transactional, repetitive processes. Differentiation, e.g., based on customer segments or products, and defined process variants are a prerequisite for the high level of automation. Significant non-customer facing activities are outsourced, e.g., collections, customer payment processing. All of the above is executed with the objective to optimize financial results, e.g., with allocating supply to priority customers.

At the peak of maturity, a company understands the order-to-cash process as a competitive advantage. The scalable end-to-end process amplifies cost efficiency. Advanced digital technologies such as Artificial Intelligence, Machine Learning and chatbots ensure a highly automated process. The entire value chain including risks is analyzed and integrated into process optimization initiatives.

By enhancing competitiveness, a transformed order-to-cash process will unlock benefits for the entire company, its employees, and its customers. Increasing the level of automation, system integration and collaboration with suppliers and customers is essential to achieve these goals.

In our upcoming article, we will share a business case and outline concrete measures to turn you order-to-cash process into a true game changer for your company.

__________

Transforming the order-to-cash process can lead to a stable cash flow and better response time towards customers, adding to a good customer experience. Still, the process has been neglected in many companies. Our blogs series shows the benefits of investing into order-to-cash processes.

__________

We would like to thank Miriam Prein for her valuable contribution to this article.

The pharma market trends impact logistics with a shift to smaller, higher-value shipments and new temperature requirements.

This blog post explores the role of remanufacturing and outlines how it can be successfully integrated into Product Lifecycle Management.

No-Code technologies allow businesses to adapt their transport management strategies swiftly and flexibly without complex programming.

In this blog post, you will learn the important difference between CX software solutions and customer experience as a business orientation.