The Power of Automation in Data Migration

Automation is a practical solution to speed up and optimize the entire data migration process

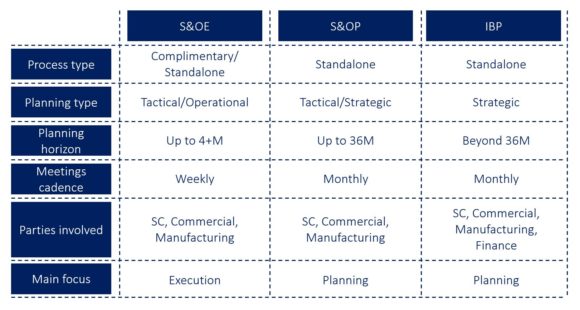

Aligning demand and supply via Sales & Operations Planning (S&OP) is nowadays a standard across industries. Supply chain planning can become even more successful when combined with Finance planning into Integrated Business Planning (IBP). In this blog post, we are pointing out five key challenges when moving from S&OP to IBP, and five strategies to overcome them.

Let’s first look at the definition of S&OP and IBP.

Sales and Operations Planning (S&OP) is a cross-functional process that businesses use to optimize their resources, operations, and profits by aligning demand forecast and supply in a tactical, 36-month time frame. The process entails integrating data from various departments within a company, such as sales, manufacturing, supply chain, and commercial, to create a comprehensive plan that addresses short- and long-term goals and aids in better end-to-end decision-making.

In recent years many companies decided to further enhance their planning processes with the more sophisticated approach of Integrated Business Planning.

Integrated Business Planning (IBP) is an enhancement to S&OP that promotes close interlinkage between operational and financial planning, reconciling volumes and values to drive better senior stakeholder decision-making. IBP helps to orchestrate other mid to long-term plans, such as product launch and portfolio management, procurement strategies, and revenue management.

In addition to integrating financial processes into S&OP, various businesses, particularly those operating in highly uncertain business environments, felt it necessary to concentrate on shorter-term planning and execution. Another methodology known as Sales & Operations Execution (S&OE) was introduced to meet business expectations.

In this article, we want to focus on the journey from S&OP to IBP. Before reflecting on the typical challenges and how to overcome them, let’s first look at the three main implementation levers of IBP and how much they are followed by businesses.

According to a study from 2022 of all businesses that have IBP implemented:

The three aspects mentioned here are critical for IBP to be successful. Lack of any of these can hinder a common understanding of raised topics and lead to disruptions. From our point of view, the third aspect, shared metrics and accountabilities, is not only the most crucial and the most difficult one to achieve but also the essential success factor guiding a transformation path from S&OP to IBP. Why is it so difficult to establish IBP as a cross-functional forum with discussions leading to more holistic long-term planning? We want to present the five most common obstacles and ways to overcome them.

Turning an S&OP process towards IBP means integrating Finance and Supply Chain processes. Usually, companies face multiple challenges during the transformation. We have noted down the top five challenges from our perspective:

A functioning budgeting and financial planning process is one of the core processes a company will have implemented. Setting up state-of-the-art Supply Chain processes, such as S&OP, is usually rather a second priority. Therefore, the maturity status of the two processes, financial planning and Supply Chain planning often differs. This makes the combination of both processes difficult since expectations on standards and content by Finance can be difficult to achieve. The yearly Finance submission cycle often happens early in the month, while Supply Chain functions will have to wait for the previous month to pass by to start doing analysis. Combining meeting timelines is often difficult since less preparation time for Supply Chain topics remains.

Finance and Supply Chain departments have by definition a different perspective on the same topics, e.g., while Supply Chain functions would analyze inventory coverage levels, Finance would be interested in the working capital effect of the same. This makes it often complicated to get the same understanding of a certain topic, derive the right conclusions, and see value from both sides.

Finance and Supply Chain functions operate in their own spheres with own KPIs and calculation methodologies. For example, forecast accuracy is usually calculated differently. While Finance would be interested in a one-month or one-year lag at the end of the fiscal year, typical Supply Chain departments look at three or six-month lags to calculate forecast accuracy. Also, some standard Supply Chain KPIs like OTIF, Days on Hand (DoH), or Forecast bias can be very specific and new to Finance functions, such that proper training might be required.

Depending on the industry and company, revenues and prices can be a very confident topic – even within the own company or between different country stakeholders since prices shall sometimes not be compared. This information is only accessible to a certain subgroup that signs special NDAs. Supply Chain departments are usually not part of this group. This makes bidirectional sharing of information and joint meetings difficult.

In the S&OP process usually, a rolling horizon of up to 36 months is analyzed, which is critical to monitor for triggering supply for new products and avoiding bottlenecks. Finance always very much focuses on the year-end budget and how targets can be met. Often bonuses also depend on the target achievement. The further the year goes, the more the mismatch becomes transparent since the year-end is coming closer.

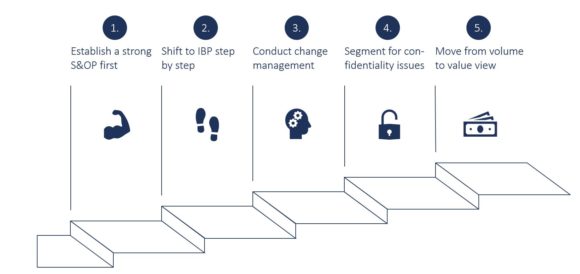

To move forward, optimize planning, and become more efficient, companies will not be able to stick to separating Supply Chain and Finance planning processes. IBP will become the new standard. This means that the above-mentioned challenges need to be overcome. We see five steps to ramp up IBP successfully.

Before considering moving from S&OP to IBP and integrating Finance elements, a strong S&OP process with stakeholder buy-in should be established. If an S&OP process is implemented and has proven its robustness, it is much easier to combine with an already well-established Finance process.

Try to avoid wanting too much from the beginning. The target picture should be an integrated meeting with joint preparation of slides showing both volume and value view. However, it will need time to achieve that. Therefore, in the first joint meeting, the approach and the purpose of S&OP/IBP should be explained and agreed on. As the next step, content can be prepared separately and shared before the meeting. Afterward, joint preparation should be considered. Combining volume and value view would be the third step since it requires additional preparation time in an anyway tough timeline.

Without proper preparation and knowledge built-up of key stakeholders on both sides, Supply Chain and Finance, IBP will not be a success. Workshops need to be conducted to demonstrate the value of a joint process. Here, it is especially important to convince Finance of the contribution and value of Supply Chain topics. This could be done by making relevant information transparent on a regular basis, like supply status and stock-out risks, or calculating financial implications like non-delivery or scrap costs in case of shelf-life requirements.

A joint approach does not mean everything needs to be shared. There might remain some highly confidential Finance topics in which Supply Chain functions will not be able to take part. However, this is often also not required. The key is to combine the forecasting process of Finance and Supply Chain functions and to do a joint review of assumptions and forecast performance. If values and prices are made transparent in the meeting, Supply Chain functions should sign additional NDAs to keep confidentiality.

To make IBP a success, it is important to keep the engagement and stakeholder buy-in always at a high level. This can be achieved by Supply Chain functions always quantifying the revenue (value) implications of Supply Chain decisions, e.g., cancellation of a bulk order or the stock-out for a certain product for two weeks. If business implications are made transparent, Finance engagement will be there.

Incorporating Finance into the S&OP process provides numerous advantages to businesses (e.g., volumes and values reconciliation), and the process of introducing a combined approach is not as challenging when following our five-step guide. Looking ahead, it is expected that more businesses will adopt Enterprise Business Planning (EBP) in the coming years. EBP is a planning methodology that goes beyond IBP by integrating all aspects of business planning, including pricing and marketing. It is the most advanced and innovative methodology, focusing on scenario planning and encompassing the entire planning horizon, from operational to strategic. Despite being very detailed and combining Commercial, Supply Chain, and Finance insights, both IBP and EBP might not be enough in a very dynamic and uncertain business environment. This is where Sales & Operations Execution (S&OE) comes in. Our next article will show why S&OE is a beneficial addition to S&OP in such an environment and how to implement it successfully.

We would like to thank Florian Kreitz for his valuable contribution to this article.

Automation is a practical solution to speed up and optimize the entire data migration process

Discover how you can streamline your financial master data management and reengineer financial processes with SAP MDG Finance.

Whilst it seems straightforward to carry out either a blood transfusion or a data migration, the actuality proves far more complex.

In this blog article, Camelot introduces you to the main principals of Demand-Driven Supply Chain Management.