The Power of Automation in Data Migration

Automation is a practical solution to speed up and optimize the entire data migration process

In a series of articles, we discuss the state of S&OP (Sales & Operations Planning) and IBP (Integrated Business Planning), including topics like scenario planning, resilience, or Green S&OP. The first article in the series detailed why S&OP still merits attention. In this article, we describe how to design a forward-looking, cross-functional and integrated S&OP process from scratch.

When demand from industries like automotive, electronics, white goods or lumber reached (near) pre-pandemic levels in 2021, many supply chains got caught cold. While demand returned much quicker than initially forecasted, supply chains were still in crisis mode. Corporate departments close to the markets quickly realized the shift but were not able to distribute the information through their organization. In a situation like this, a strong sales & operations planning (S&OP) process helps to achieve better end-to-end business decisions in a hyper-volatile environment.

But what exactly are the attributes of a “strong” S&OP process?

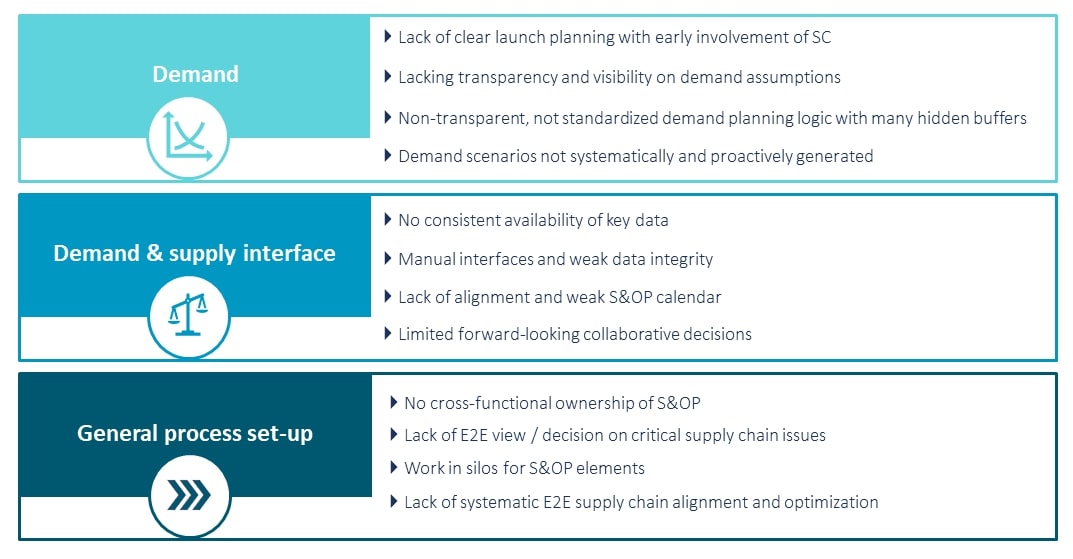

The design of an S&OP process has implications ranging much further than aligning supply and demand. Getting the design right and avoiding problems from the very beginning is a prerequisite for keeping the process scalable and strong. As we have experienced in many basic S&OP implementations and reviews, there are generally issues from three areas: demand planning, supply interface, and process setup.

Whether you are doing a detailed bottom-up forecasting or a fully automated statistical top-down approach and have a high forecast accuracy, forecasts of new product launches seem to be a challenge for the organization. A key driver for this is the insufficient involvement of supply chain experts in launch planning. In many cases, supply chain functions get involved rather late, directly go into a fire-fighting mode to fulfill the demand on time and are forced to take long-term decisions in a short-term timeframe.

Related to launch problems is the non-systematical and proactive generation of demand scenarios to depict and understand impact of various possibilities for a discrete event. For supply chain departments, it is important to understand the connection between a demand scenario with key milestones like, for example, launch dates in major markets, a release date of an important marketing campaign, or the expected date of external regulation incentivizing a specific solution.

The demand planning itself is, in general, not as transparent as it should be. The underlying assumptions for demand are invisible to the supply chain function in many cases. These assumptions might be about market share in a country or cannibalization effects of new launch products. It is important for supply chain functions to understand these assumptions so that they know when to react (change in assumptions) and when to wait (in case of normal demand fluctuations).

When demand meets supply, we have seen many companies getting stuck with manual data crunching with the result that they do not get to decision-making itself. Key data is taken from spreadsheets and reports rather than from systems. With that comes a high risk for misaligned data. At this point, many meetings will appear on the agenda to identify the current status of supply and demand. However, very often these meetings result in only a weak alignment for S&OP. Collaborative forward-looking decision-making will not be possible. S&OP will be seen as a “supply chain thing” rather than a cross-functional approach.

Finally, the general process setup of S&OP is often a problem. One of the core mistakes is not to design S&OP cross-functionally from the very beginning. If S&OP does not include non-supply chain related functions such as commercials or marketing, there will be no end-to-end view of the supply chain and no joint decisions on issues.

A lot of organizations have different elements of S&OP dispersed among local, regional and global/corporate-level functions. Even if global goals are set, local or regional planning functions often work in silos and do not think about their interfaces with other regions or business units. Those siloed functions/levels often work in reaction to goals and KPIs set on levels above them. They do not participate in decision-making even though the proper alignment between all stakeholders from local to global levels is key to harmonizing and standardizing the S&OP process.

Many S&OP processes fall short to optimize the end-to-end supply chain and conduct continuous optimization. Through the S&OP process, core supply chain topics get discussed and decided at various levels cross-functionally. If no decision can be made in a meeting, the issue is escalated to senior management. Obviously not only operational issues need to be discussed. A fair share of content in a meeting should be on tactical or strategic improvement potential.

To mitigate the above-mentioned issues and to come up with a strong design of a new or revised S&OP process, we advise to work with the following guiding principles.

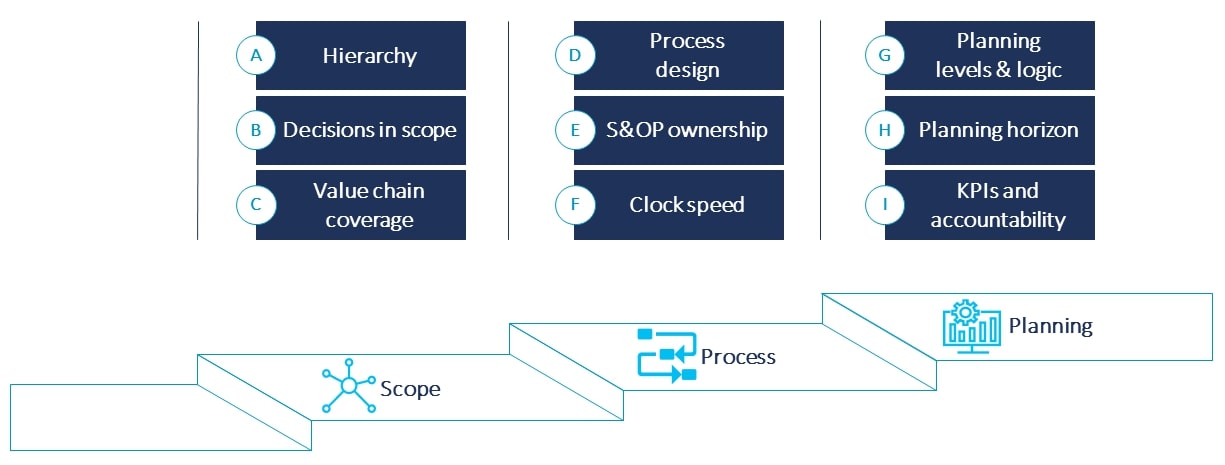

Considering these guiding principles, the S&OP process should be set up in three building blocks: scope, S&OP process, and planning of demand & supply.

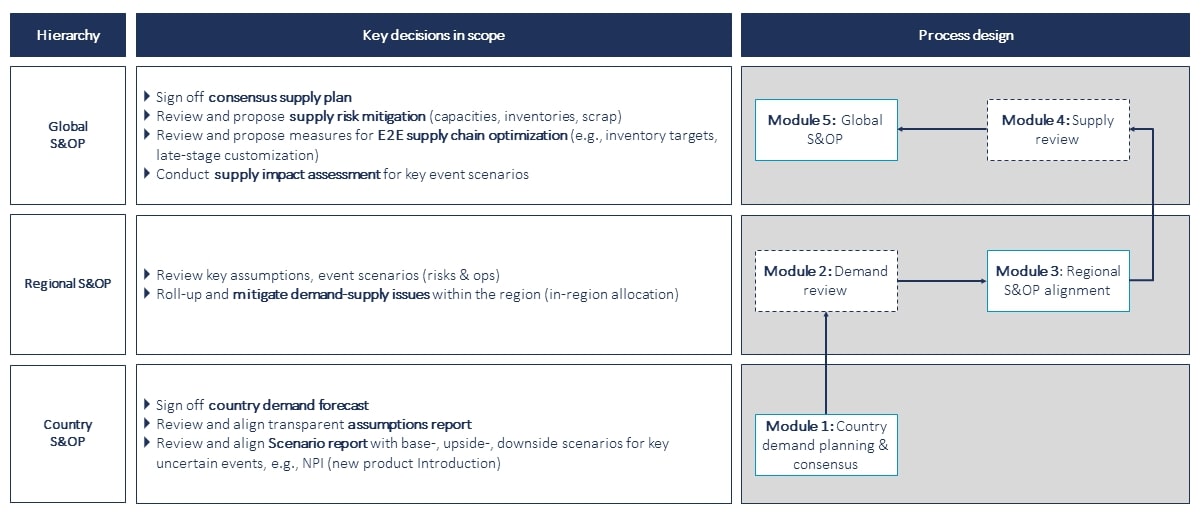

The scope is the framework for the overall S&OP process. At first, it must be decided which hierarchies (levels) should be involved in the S&OP process and which decisions are taken at which hierarchy level. In many large companies, the starting point is country commercial, which usually owns the country demand forecast including market assumptions. Furthermore, demand scenarios are created at this level. At the regional level, assumptions and certain events are reviewed and in-region demand/supply issues discussed, e.g., shared SKUs or local supply. At the global level, demand is matched with supply from global sites. The outcome should be a consensus for a joint supply plan. Furthermore, in case of demand scenarios, supply options need to be calculated and evaluated in a so-called supply impact assessment. Topics such as end-to-end supply chain optimization and supply risk mitigations also get discussed at the global level.

Another topic that needs to be defined in the building block “scope” is the value chain coverage. Within the S&OP process, only a part of the value chain is taken into consideration as certain areas are decoupled from planning. The reason is that they are assumed to be infinite (e.g., raw material procurement) or that the information is too granular (e.g., customer of the customer).

Once the scope is set and it is clear what kind of decisions need to be taken at specific hierarchy levels, a detailed process design follows. Hereby the S&OP decision meetings are planned backwards from final decisions to start, to cover all necessary tasks. For each meeting, an agenda needs to be created and the relevant stakeholder roles have to be defined. The RACI framework can be used to define roles and responsibilities. Preparation rounds or reviews are needed to prepare necessary decisions for the main meetings. As a rule of thumb: Every S&OP session requires one preparation round. To avoid the pitfall of overloading an S&OP meeting, the duration should not be longer than 60 minutes.

Once the decision meetings are settled, S&OP ownership needs to be decided for each meeting. The owner of the meeting is responsible for sending out invitations in time, making sure the necessary reports and decision tasks are created, and for running the S&OP meeting. Especially on a country level, we have seen people from a variety of departments running the meetings (commercials, finance, marketing, regional supply chain, etc.). It is not important which department runs the meeting, but it needs to be ensured that the owner runs it with a cross-functional perspective.

The final design choice regarding the process is the clock speed or the time interval between meetings. A monthly cycle is rather common in many organizations. There might be cases, e.g., long lead times, that indicate that a quarterly cycle is sufficient.

Once the decision needs are clear and the meetings have been scheduled, the content for the meeting must be prepared. Detailed planning levels and logic for demand planning, supply planning and reporting of inventories need to be established. For example, in high-margin pharma areas, effort is invested to come up with an accurate patient-built model on SKU basis to help identify parallel trade from the very beginning. In other industries, e.g., steel building capacity, utilization and grade margins are more important, so a lot of calculations are put into the supply product mix.

Within the planning horizon the reach of the demand forecast and supply plan are determined. A key driver to decide on the horizon are lead times from the value chain coverage decoupling point towards the point of demand. If data is too uncertain to predict future demand in the long run, an aggregation by product groups or larger time intervals (quarterly instead of monthly) will help to come to a good forecast.

Finally, to steer S&OP decisions, KPIs and related accountabilities are needed. It is decided what metrics are tracked and who is responsible for the creation of metrics. We strongly recommend sticking with a few standard KPIs to make monitoring as easy as possible. From our experience, two or three metrics per hierarchy level will tell 80 percent of the story. In demand planning for example, we think forecast bias and accuracy should be sufficient to evaluate forecast performance and track it over time. Target setting for KPIs should also follow a clear and reasonable guideline. Cornerstones for the target are the company’s capabilities, e.g., IT support and the environment in which it operates. For example, a bias should never be accepted, but in the case of high demand uncertainty it is unreasonable to expect high forecast accuracy.

A forward-looking, cross-functional and integrated S&OP is important to come to aligned decisions quickly and to react to changing circumstances as fast as possible. Considering the level of uncertainty in global value chains, including external shocks in logistics and political decisions, companies should act swiftly to be a frontrunner and create competitive advantage by a well-designed and strong S&OP process.

The basic S&OP process described in this blog post is only one building block for a “state-of-the-art” S&OP/IBP process. In the next article (planned), we will show how to integrate financial topics into S&OP and reach integrated business planning (IBP).

Our first blog in this series answers the question of why bother with S&OP.

Automation is a practical solution to speed up and optimize the entire data migration process

Discover how you can streamline your financial master data management and reengineer financial processes with SAP MDG Finance.

Whilst it seems straightforward to carry out either a blood transfusion or a data migration, the actuality proves far more complex.

In this blog article, Camelot introduces you to the main principals of Demand-Driven Supply Chain Management.