Navigating Pharma Logistics: Trends, Challenges, and Solutions for 2025

The pharma market trends impact logistics with a shift to smaller, higher-value shipments and new temperature requirements.

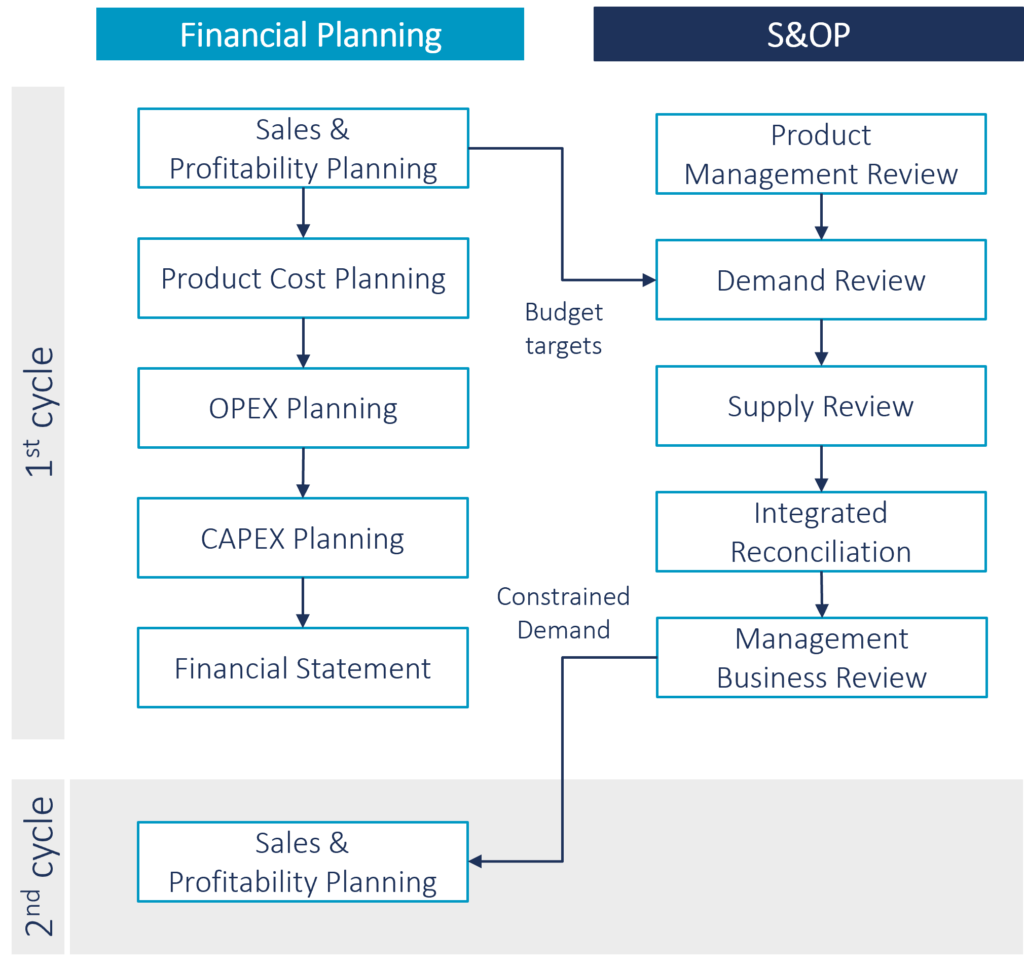

Many organizations struggle with a critical disconnect between financial planning and Sales & Operations Planning (S&OP). This fragmented approach creates a multitude of challenges. In this blog article, you will learn why connecting financial planning with sales and operational planning is crucial to steer your company towards success. We will also share how an integrated approach can be implemented using SAP technology. Finally, you will get an insight into a practical example based on one of our recent projects.

Gaps between financial and sales and operational planning manifest as siloed information, hindering collaboration and leading to outdated data reliance across finance and the supply chain. Without clear financial insights, the supply chain struggles to make informed decisions. Furthermore, limited scenario planning capabilities and unrealistic financial targets restrict informed decision-making, especially in critical situations. This widening gap between financial and S&OP planning demands a clear strategy to bridge the information divide.

The key to overcoming these hurdles lies in integrating financial, sales, and operations planning. This unified approach fosters alignment through:

Connecting financial, sales, and operational planning provides a multitude of benefits:

Firstly, increased transparency between financial and supply chain planning leads to enhanced data accuracy and reduced fluctuations. With both departments working from the same data set, discrepancies and misunderstandings become a thing of the past. This translates into more reliable forecasts and budgets, allowing for better resource allocation.

Secondly, supply chain planning can be strategically steered towards achieving financial targets. With clear visibility into financial goals, supply chain decisions regarding capacity, sourcing (make-or-buy), and resource allocation can be optimized to align with overall financial objectives.

Finally, the integration of sales, supply chain, and finance fosters a culture of collaborative decision-making. Consistent planning scenarios based on unified data empower all departments to work towards shared organizational goals. This fosters a sense of shared responsibility and accountability, leading to more informed and strategic choices across the entire organization.

A leading semiconductor company faced a decentralized planning process reliant on disparate Excel spreadsheets. This fragmented approach lacked comprehensive financial planning and integration with S&OP, leading to disjointed handoffs and inconsistent planning data.

The company undertook a strategic initiative to:

By implementing these changes, the company achieved:

Integrating financial planning with S&OP offers a powerful path towards achieving a truly unified business plan. By breaking down silos and fostering a collaborative environment based on shared data, companies can make more informed decisions, streamline operations, and achieve lasting success.

Authors: Henning Holländer, Alexander Föller

The pharma market trends impact logistics with a shift to smaller, higher-value shipments and new temperature requirements.

This blog post explores the role of remanufacturing and outlines how it can be successfully integrated into Product Lifecycle Management.

No-Code technologies allow businesses to adapt their transport management strategies swiftly and flexibly without complex programming.

In this blog post, you will learn the important difference between CX software solutions and customer experience as a business orientation.